Ohio Bankruptcy Exemptions 2025 - That is a similar rate of acceleration as in the dec. The federal bankruptcy homestead exemption is currently $25,150 for cases filed on or after april 1, 2019. Chapter 7 Bankruptcy Exemptions The Needleman Law Office, Edited by anne marie lee. Single is 65 or older:

That is a similar rate of acceleration as in the dec. The federal bankruptcy homestead exemption is currently $25,150 for cases filed on or after april 1, 2019.

Ohio Bankruptcy Statistics 2019 2022 Richard West, According to statistics released by. How does bankruptcy work in ohio?

Ohio Bankruptcy Michael E. Plummer & Associates, You may exempt any property that falls into one of the exemptions categories below, up to the dollar amount listed. How much can i exempt in a chapter 7 bankruptcy filing?

Ohio Bankruptcy Exemptions 2025. Chapter 13 bankruptcy may allow you to keep your property (like a house or vehicle) by creating a new plan for you to pay your debt over time. The figures below are accurate as of february of 2025.

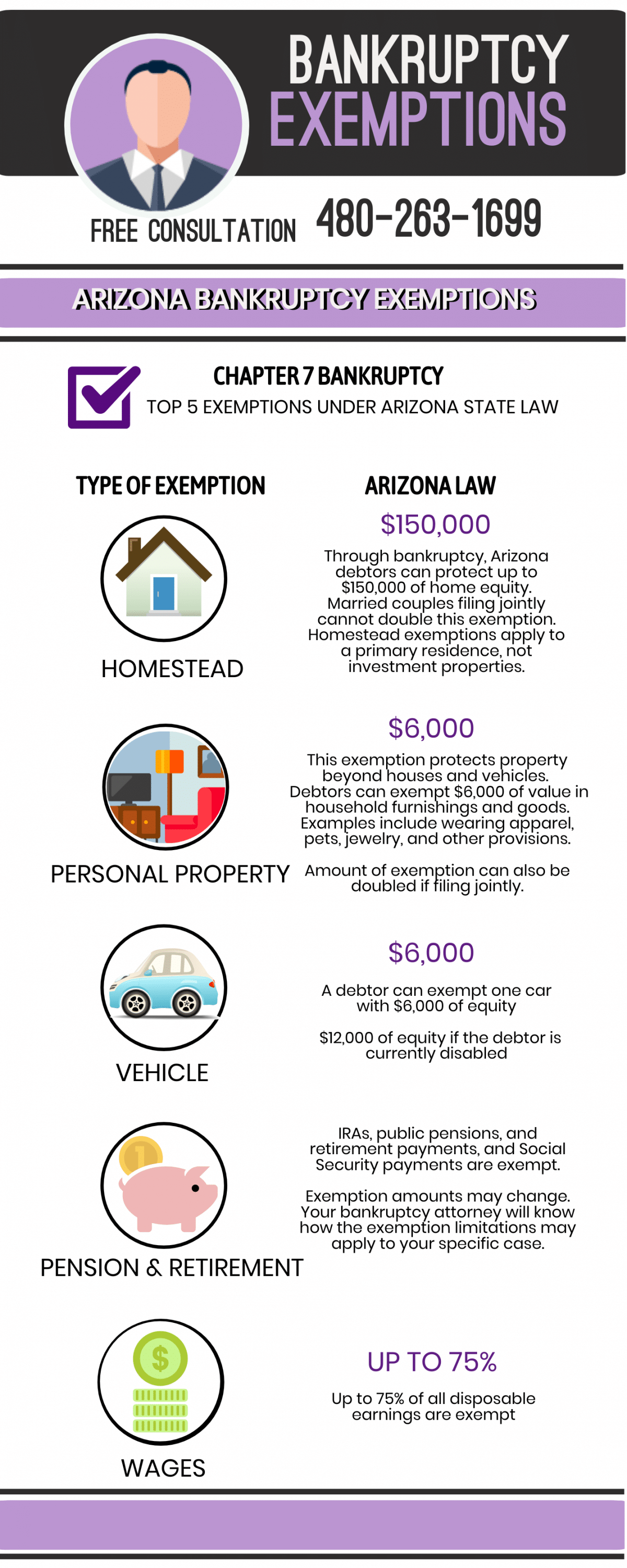

Chapter 7 Bankruptcy Exemptions in Arizona Judge Law Firm, To see all of them, you can take a look at the ohio revised codes. The figures below are accurate as of february of 2025.

What Can Be Exempted in Bankruptcy Phoenix Bankruptcy Attorney, The figures below are accurate as of february of 2025. Learn about the most common exemptions used to protect property in an ohio bankruptcy case.

Bankruptcy Exemptions CGA Law Firm, A list of some new chapter 11 bankruptcy filings made during the last week. However, ohio filers can use the federal nonbankruptcy exemptions.

How to Determine if You Quality for Filing Chapter 7 Bankruptcy in Ohio, On april 1, 2022, the value of property exempt from execution, garnishment, attachment, or sale under ohio revised code 2329.66 increased. Property you can't exempt in an ohio bankruptcy.

The ohio bankruptcy means test is designed to show whether you qualify for chapter 7 bankruptcy.

Daniel Gigiano Reviews Daniel Gigiano Reviews Ohio Bankruptcy And, How much can i exempt in a chapter 7 bankruptcy filing? Compare your income to the median incomes for cases filed on or after april 1, 2025.

Utah Bankruptcy Exemptions Kevin Martin, The federal bankruptcy homestead exemption is currently $25,150 for cases filed on or after april 1, 2019. The code provides federal bankruptcy exemptions.

The next update on exemption amounts is scheduled to occur on april 1, 2022.

To see all of them, you can take a look at the ohio revised codes.

Requiring the vast majority of water systems to replace all their lead pipes within the next ten year.

Ohio Bankruptcy Exemptions What Property Can I Keep?, Exempt property and assets in ohio bankruptcies. The government revises these figures every three years to account for inflation.